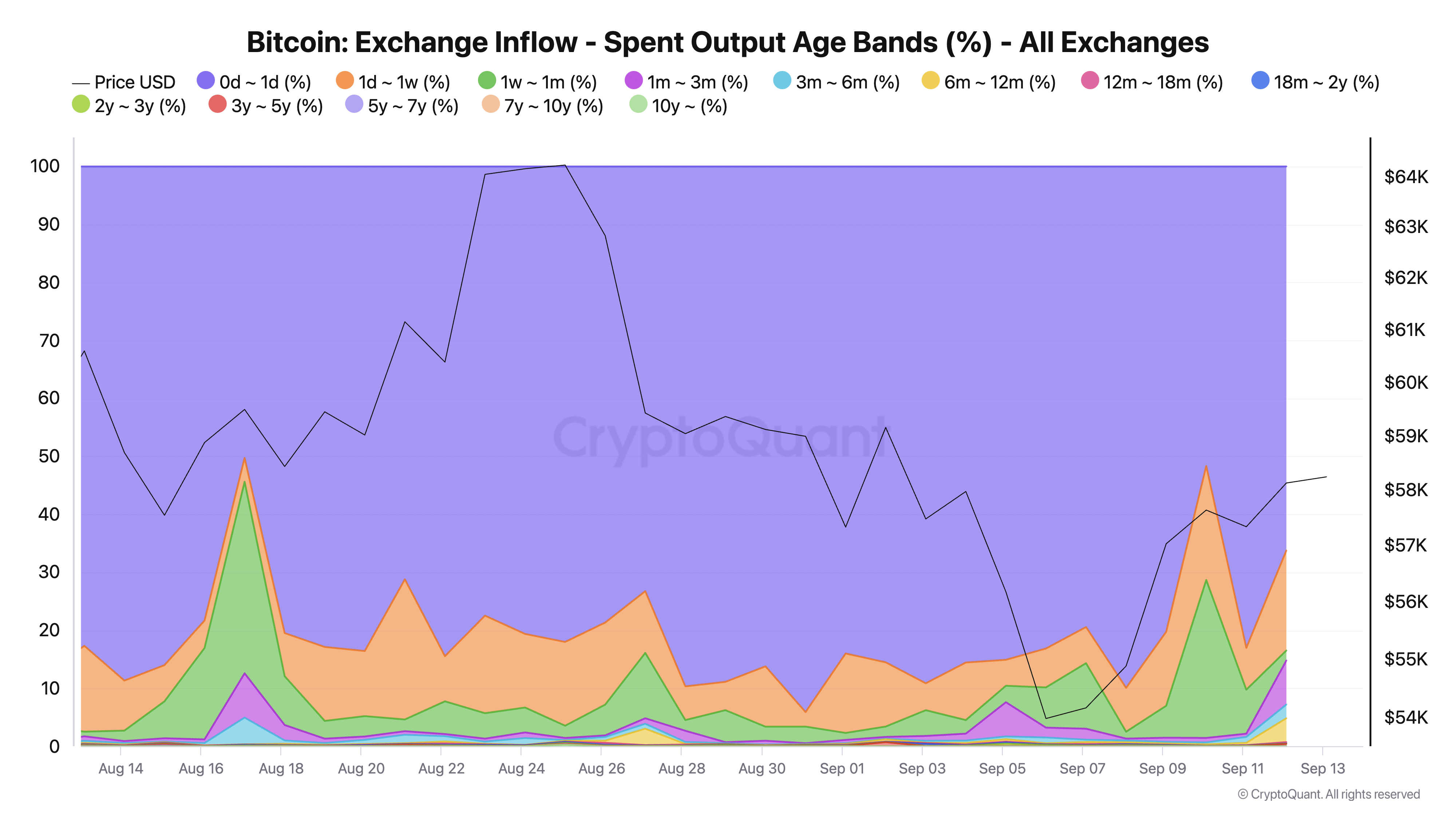

In the past month, the majority of Bitcoin exchange inflows have come from short-term holders, based on CryptoQuant data.

According to the data, addresses that held BTC for less than three months made up over 92% of the total exchange inflows on Sep. 12. Over 83% of exchange inflows came from coins held for less than a week.

This distribution of inflow age bands shows the dominance of speculative traders looking to capitalize on short-term price movements. This behavior is typical in a volatile market. When Bitcoin experiences rallies, these short-term holders are the first to sell, contributing to significant price fluctuations.

Graph showing all spent outputs created within a certain age band that flowed into exchange wallets from Aug. 13 to Sep. 13, 2024 (Source: CryptoQuant)

However, there has also been a notable increase in exchange inflows from long-term holders — those who have held their coins for over three months. The increase in inflows from coins held for over three months — up from 0.55% on Sep. 11 to 7.59% on Sep. 12 — suggests that some long-term holders are also beginning to take profits. While short-term traders dominate inflows, the slight uptick in long-term selling reflects growing caution among investors who may see current price levels as an opportunity to exit.

Despite this uptick in long-term inflows, the overall volume from long-term holders remains relatively low. It indicates that most long-term investors continue to hold, reflecting underlying confidence in Bitcoin’s long-term potential. Their reluctance to sell in large volumes suggests they see current price levels as a healthy part of Bitcoin’s broader market cycle.

The trend is clear: short-term traders are driving the majority of the inflows and subsequent volatility, while long-term holders are making calculated decisions to sell selectively.

The post 92% of Bitcoin exchange inflows come from short-term holders appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  TRON

TRON  Toncoin

Toncoin  Cardano

Cardano  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  WETH

WETH  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  Dai

Dai  Polkadot

Polkadot  LEO Token

LEO Token  Sui

Sui  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Bittensor

Bittensor  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Internet Computer

Internet Computer  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  First Digital USD

First Digital USD  Monero

Monero  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Ethena USDe

Ethena USDe  dogwifhat

dogwifhat  Immutable

Immutable  Aave

Aave  Filecoin

Filecoin  Cronos

Cronos  Render

Render  Fantom

Fantom  Mantle

Mantle  Optimism

Optimism