Onchain Highlights

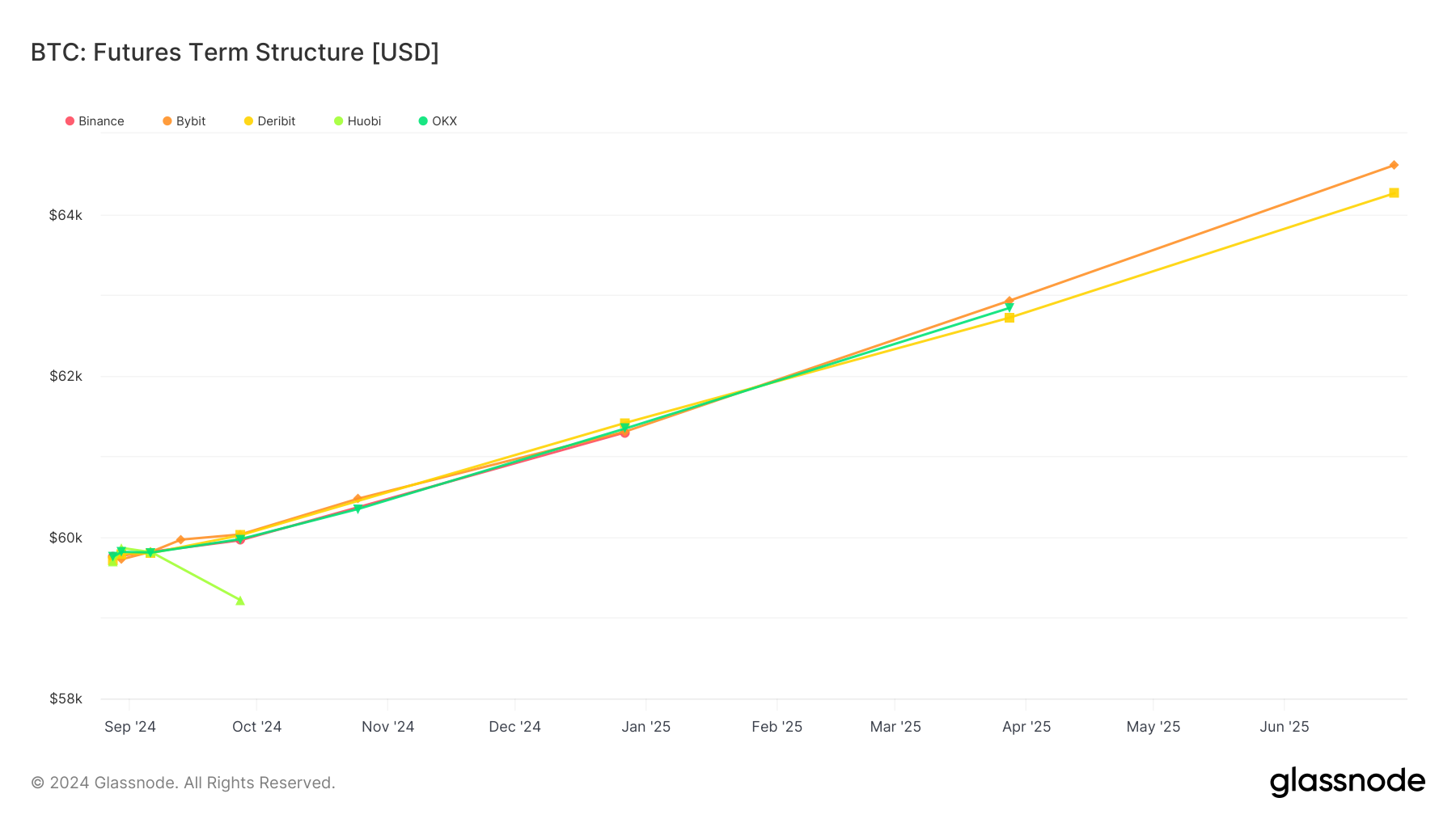

DEFINITION: The Futures Term Structure is a graphical representation of the pricing for futures contracts expiring at increasingly distant dates into the future. The most common state of the graph, an upward slope, indicates a premium must be paid to purchase exposure, or delivery, of an asset in the future. A downward slope conversely indicates a discounted rate on delivery of an asset in the future. Trends and dislocations within the graph can paint a picture of supply, demand, and liquidity for futures contracts expiring on different dates.

Bitcoin futures contracts exhibit a consistent upward slope across major exchanges, indicating an anticipated premium in the asset’s future price. As of September, the structure shows futures contracts starting around $60,000, with gradual increases extending into mid-2025.

Notably, all tracked exchanges — Binance, Bybit, Deribit, Huobi, and OKX — maintain a near-identical trajectory, reflecting a consensus in market sentiment.

This uniformity suggests stable expectations in the Bitcoin futures market, with no significant price divergence between exchanges. The upward-sloping term structure aligns with typical market behavior, where distant future contracts trade at a higher price than near-term ones. This is likely due to a combination of demand for longer-term exposure and confidence in Bitcoin’s sustained growth post-halving.

The brief dip in Huobi’s futures contracts in September highlights potential short-term volatility or liquidity imbalances, but it quickly aligns with the broader market trend. This alignment underscores the market’s overall stability and resilience.

BTC: Futures Term Structure: (Source: Glassnode)

The post Uniform trajectory in Bitcoin futures suggests stable market expectations across major exchanges appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  TRON

TRON  Toncoin

Toncoin  Cardano

Cardano  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  WETH

WETH  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Dai

Dai  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Uniswap

Uniswap  Litecoin

Litecoin  Sui

Sui  Aptos

Aptos  Bittensor

Bittensor  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Internet Computer

Internet Computer  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  POL (ex-MATIC)

POL (ex-MATIC)  Monero

Monero  Ethereum Classic

Ethereum Classic  Stellar

Stellar  Stacks

Stacks  First Digital USD

First Digital USD  Ethena USDe

Ethena USDe  OKB

OKB  Immutable

Immutable  dogwifhat

dogwifhat  Aave

Aave  Render

Render  Filecoin

Filecoin  Cronos

Cronos  Optimism

Optimism  Hedera

Hedera  Arbitrum

Arbitrum