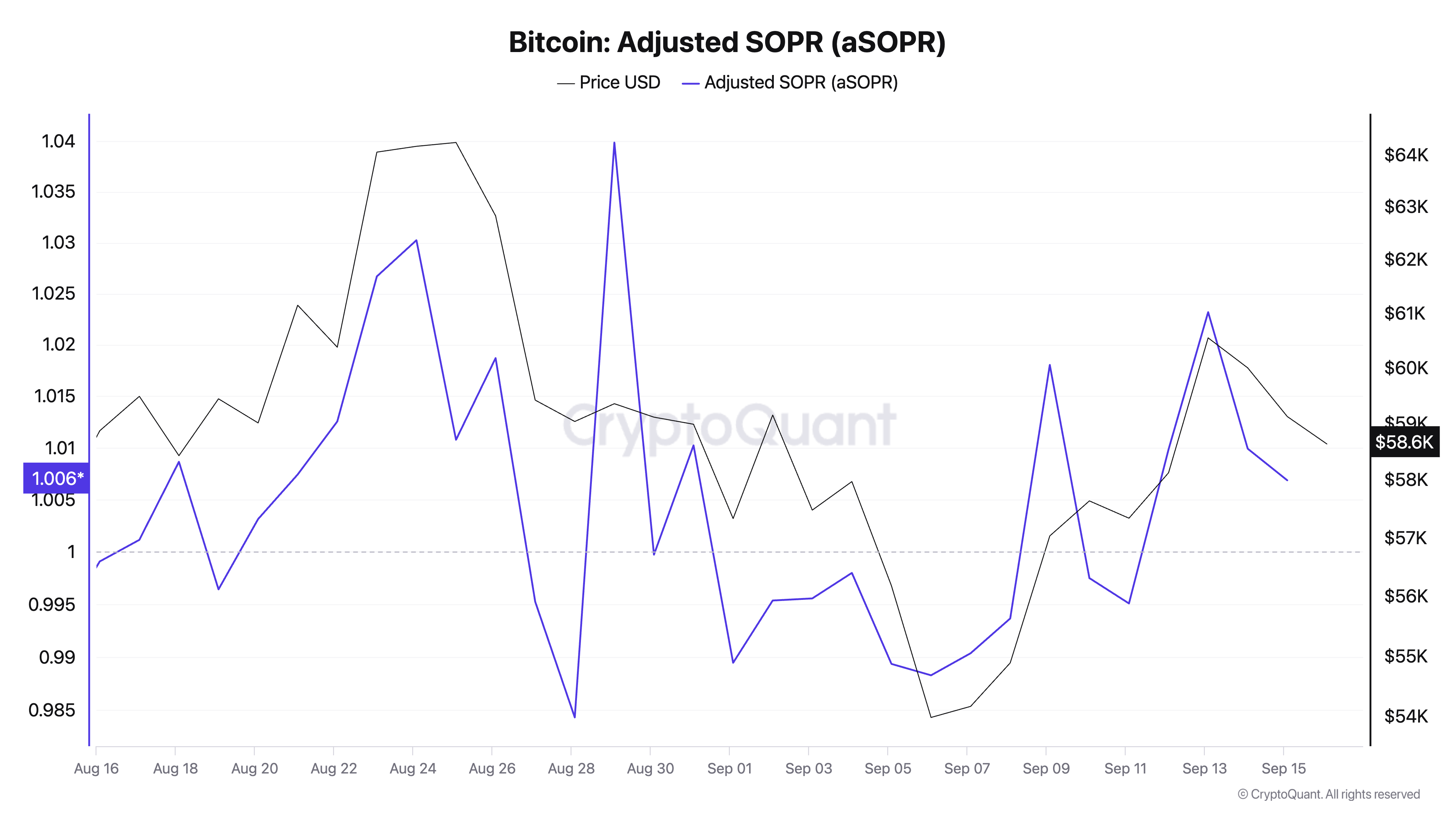

In the past week, spent output profit ratio (SOPR) data showed the market was in a profit-taking phase, influenced mainly by long-term holders. Between Sept. 6 and Sept. 13, Bitcoin’s spike from $53,900 to $60,500 was accompanied by an increased adjusted SOPR (aSOPR), indicating that coins spent during this period were sold at a profit.

During the weekend, BTC consolidated around $58,900, which led to a slight dip in aSOPR. This minor decrease indicates a pause in profit-taking rather than a shift towards loss realization. The market appeared to stabilize, hinting at a short-term equilibrium rather than a reversal in sentiment.

Graph showing Bitcoin’s adjusted spent output profit ratio (aSOPR) from Aug. 16 to Sep. 16, 2024 (Source: CryptoQuant)

The SOPR Ratio, which compares the profitability of long-term holders to short-term holders, showed a sharp increase between Sept. 12 and Sept. 15. This rise points to substantial profit realization by long-term holders, a behavior that historically signals a potential market top or at least a period of consolidation.

Graph showing Bitcoin’s SOPR Ratio from Sep. 6 to Sep. 16, 2024 (Source: CryptoQuant)

During this time, the short-term holders’ SOPR increased marginally, suggesting a move from minor losses to break-even profits. In contrast, long-term holders realized significantly higher profits, showing their strategic exit during price rallies.

Graph showing Bitcoin’s long-term holder SOPR Ratio from Sep. 10 to Sep. 16, 2024 (Source: CryptoQuant)

Overall, the data suggests a market in a profit-taking mode, particularly among long-term holders. While this indicates a strong bullish sentiment, the elevated SOPR Ratio could be an early indicator of a short-term peak or a period for further consolidation.

The post SOPR shows long-term holders are taking profits appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  TRON

TRON  Toncoin

Toncoin  Cardano

Cardano  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  WETH

WETH  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  Dai

Dai  LEO Token

LEO Token  Polkadot

Polkadot  NEAR Protocol

NEAR Protocol  Sui

Sui  Litecoin

Litecoin  Aptos

Aptos  Bittensor

Bittensor  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Internet Computer

Internet Computer  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  First Digital USD

First Digital USD  Monero

Monero  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Ethena USDe

Ethena USDe  dogwifhat

dogwifhat  Immutable

Immutable  Aave

Aave  Filecoin

Filecoin  Cronos

Cronos  Render

Render  Mantle

Mantle  Optimism

Optimism  Arbitrum

Arbitrum