[PRESS RELEASE – Singapore, Singapore, October 25th, 2024]

NODO, a leading multichain prediction markets platform, today announces its plan for a TGE in Q1 2025 and roadmap expansion towards an onmichain DeFi ecosystem, which includes integration of futures trading, yield farming vaults, copy trading, Telegram miniapp, RWA predictions, and support for BNB, TON, and SUI blockchains.

The platform aims to develop a highly functional social trading ecosystem, enabling users to participate in various trading strategies—both actively and passively—while minimizing capital requirements, offering low transaction fees, and providing instant payouts.

Unlocking Capital Efficiency With AMM Aggregation and A Feeless Infrastructure

Once a niche corner of the crypto world, prediction markets are rapidly evolving into crucial tools for crowdsourcing collective intelligence on a range of global events. One of the biggest challenges in prediction markets is the lack of true decentralization, particularly in how community ownership of prediction outcomes is structured. Retail traders in Web3 markets often struggle with limited control and influence over their investments and predictions. This issue is compounded by several factors: retail traders frequently incur financial losses by entering or exiting trades at poor times, large players (whales) manipulate the market to their advantage by trading against smaller investors, and whales often engage in pump-and-dump schemes, using retail traders as exit liquidity, which further deepens their losses.

NODO, in particular, has made significant strides in this area. One of the most promising areas of integration is with liquidity pools. NODO plans to aggregate existing automated market maker (AMM) models for its market-making, potentially creating more efficient and liquid markets for event outcomes. This move will position NODO as a prediction market aggregator, enabling traders to invest in a broader range of AMMs. Major chains supported include BNB Smart Chain and BASE, with major tokens such as USDT and USDC.

Compared to current leading prediction markets, NODO offers unique benefits including capital safety and automated payouts. The platform accomplishes this by recording transactions when users purchase shares and locking swapped assets in a vault. Once an option market matures, a cross-chain relayer claims the payout, swaps assets, and distributes them to the user’s wallet.

“The potential for retail trading market shares to be used as collateral in lending protocols is particularly exciting,” notes NODO’s Co-Founder Sowmya Raghavan. “This could create new forms of synthetic assets, expanding the range of financial instruments available in the DeFi ecosystem.”

NODO is also working with strategic partner Arthera to provide feeless transactions for its product ecosystem.

Laurent Perello, Co-Founder & CEO of Arthera and former TRON DAO advisor, shares: “Optimizing gas fees is crucial—it’s perhaps the most vital step for any community-driven Web3 ecosystem striving for widespread adoption. Arthera and NODO’s collaboration will democratize the use of prediction markets for Web2 and Web3 users”.

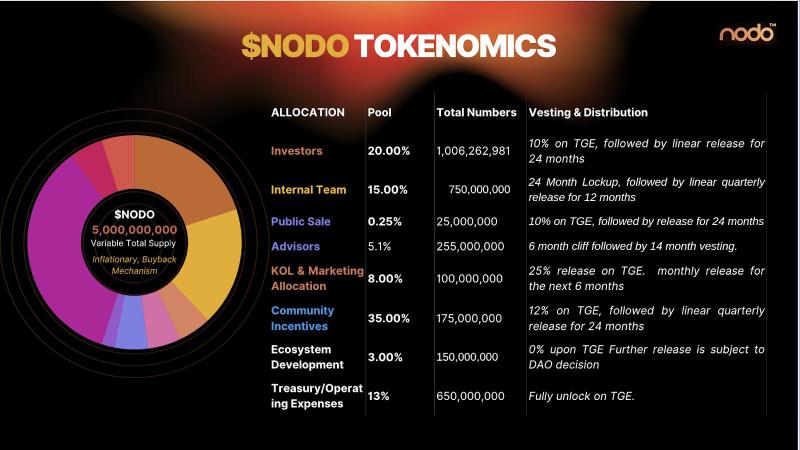

Foward-Thinking Tokenomics and Go-to-Market Strategy

NODO has shared its distribution strategy for its upcoming token launch. The NODO token ecosystem is designed to create a comprehensive framework for platform growth, community engagement, and sustainable development. Members contribute to the ecosystem by driving volume and community growth, which in return grants them platform governance through ownership of the NODO token. Token holders are able to elect or even be a part of a dedicated Security Council that oversees the platform’s liquidity pool and maintains robust security measures. The ecosystem offers a unique no-loss staking mechanism that allows users to secure their capital while maintaining the potential for rewards, effectively eliminating the risk of financial loss while participating in the platform’s growth.

To incentivize early bird adoption, NODO recently launched a social mining system that grants its most active users day-one access to the NODO token as community stakeholders by accumulating “XP Shares” through daily platform engagement. This unique community program has garnered notable traction for NODO across key crypto markets including the US, Nigeria, Kenya, South Africa, Indonesia, Vietnam, and Russia.

About NODO

NODO is an omnichain social futures trading ecosystem with over 380,000 users across 14 countries, blending gamification with instant-payout prediction markets. Users can forecast real-world events through NODO prediction markets, while NODO 0DTE Options provide instant payouts for short-term cryptocurrency price predictions, aggregating multiple AMMs for capital efficiency and low fees. NODO is building a gamified social trading ecosystem where users earn daily rewards and achieve ecosystem governance by contributing to community market sentiment.

Twitter | LinkedIn | Telegram | Discord

For more information, users can visit nodo.xyz

For any inquiries about this release, users can contact sowmya@nodo.xyz or team.nodo@nodo.xyz

The post NODO Plans Q1 2025 Token Sale, Debuts Omnichain Trading Vaults Next Month appeared first on CryptoPotato.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  TRON

TRON  Toncoin

Toncoin  Cardano

Cardano  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  WETH

WETH  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  Polkadot

Polkadot  USDS

USDS  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Sui

Sui  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Internet Computer

Internet Computer  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  WhiteBIT Coin

WhiteBIT Coin  Stacks

Stacks  First Digital USD

First Digital USD  Ethena USDe

Ethena USDe  dogwifhat

dogwifhat  Immutable

Immutable  OKB

OKB  Filecoin

Filecoin  Aave

Aave  Arbitrum

Arbitrum  Optimism

Optimism  Render

Render