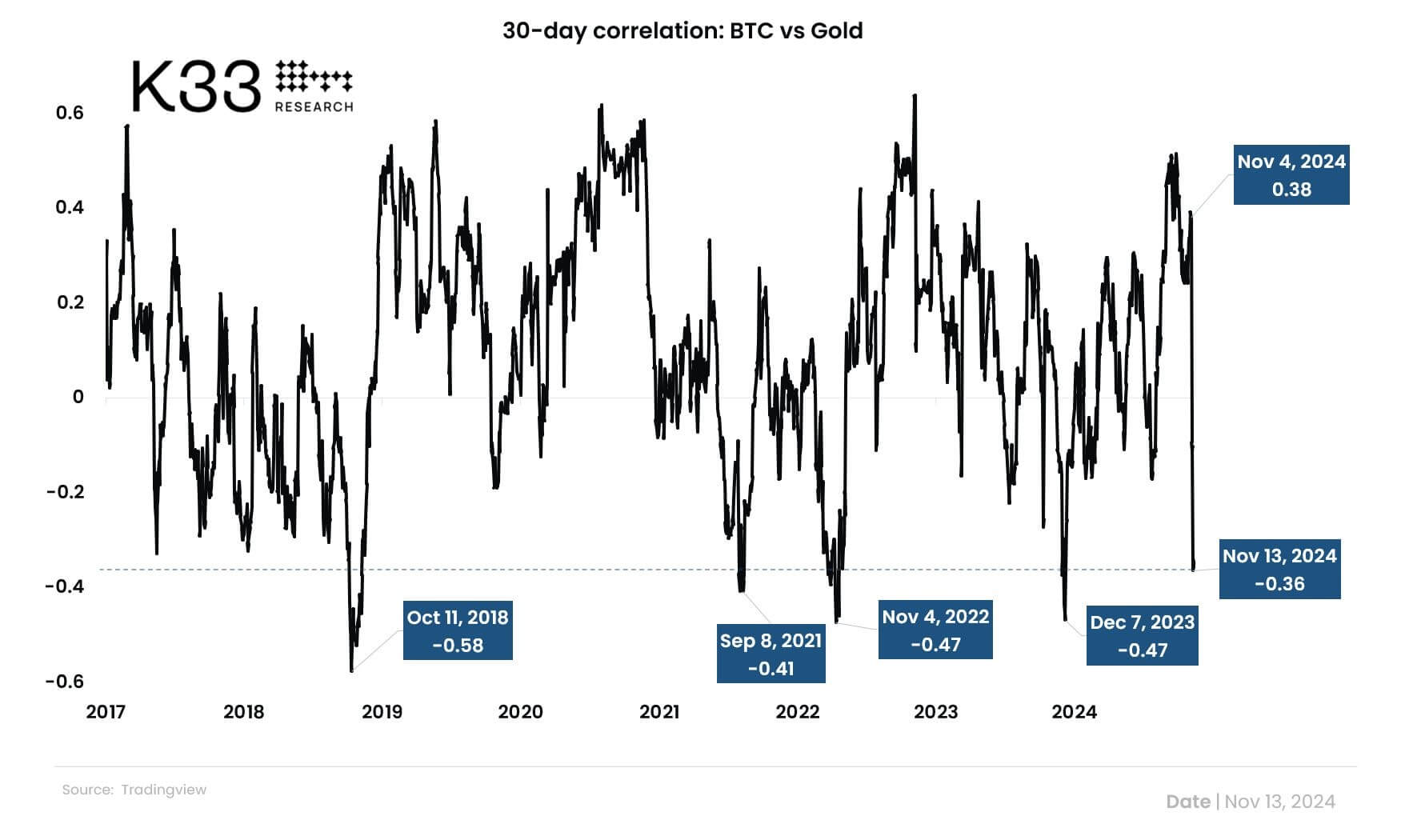

Bitcoin’s correlation with gold prices has fallen to its lowest level in nearly a year following Donald Trump’s recent election victory on Nov. 5.

According to K33 Research, the 30-day correlation between Bitcoin and gold stands at -0.36, its lowest level since December 2023. In correlation terms, a value of 1 signifies a perfect positive relationship, where both assets move in tandem, while -1 reflects a perfect negative correlation, indicating they move in opposite directions.

Bitcoin and Gold Correlation (Source: K33 Research)

Historically, Bitcoin and gold have often moved independently. This lack of consistent alignment is evident in recent price movements, with BTC reaching new highs toward $90,000 as gold prices declined.

This trend suggests that investors favor BTC over traditional safe-haven assets like gold. A key driver of this shift is the belief that a second term for Trump could provide regulatory clarity, fueling growth for Bitcoin and the broader crypto market.

So, as BTC gains recognition as “digital gold,” its appeal as a hedge against inflation and economic uncertainty continues to attract institutional and retail investors. Gold, meanwhile, may be losing traction as some investors reallocate funds to BTC, drawn by the prospect of higher returns in the burgeoning digital asset space.

The post Bitcoin’s correlation with gold hits lowest level in a year post Donald Trump victory appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Pepe

Pepe  Polkadot

Polkadot  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Stellar

Stellar  Cronos

Cronos  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bittensor

Bittensor  dogwifhat

dogwifhat  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Dai

Dai  POL (ex-MATIC)

POL (ex-MATIC)  Hedera

Hedera  WhiteBIT Coin

WhiteBIT Coin  Ethena USDe

Ethena USDe  Stacks

Stacks  OKB

OKB  Bonk

Bonk  Filecoin

Filecoin  Monero

Monero  Render

Render  Arbitrum

Arbitrum