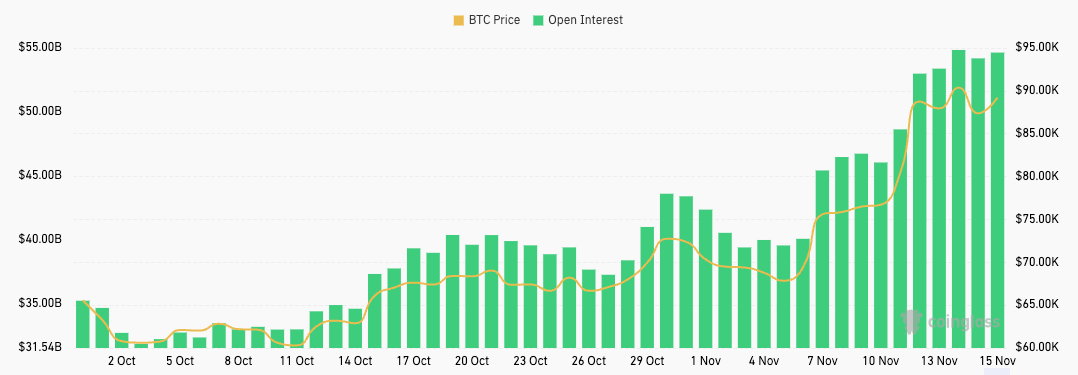

Bitcoin’s futures open interest grew from $34.68 billion on Oct. 1 to an all-time high (ATH) of $54.85 billion on Nov.14.

This increase of over 58% since the start of October and 29% since the beginning of November shows a significant influx of capital and increased trader participation, with much of this growth accelerating after the US election.

Graph showing Bitcoin futures open interest from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

Futures also saw a dramatic increase in trading volume, with daily volume peaking at just over $207 billion on Nov. 13, marking the fourth-largest trading volume ever recorded. The surge in open interest and volume shows a significant increase in speculation and leveraged trading, an inevitable side-effect of a bull rally.

Graph showing Bitcoin futures trading volume from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

While Bitcoin’s derivatives are growing steadily, with both old and new exchanges becoming prominent players in the space, half of the market is still dominated by two platforms — CME and Binance. This is why the changes in their market share and growth trajectories often reveal nuances in market sentiment that aren’t that obvious when looking at the big picture.

In the past 40 days, Binance accounted for a substantial portion of the total futures market, with its open interest increasing steadily from $7.47 billion on Oct.1 to a record $10.61 billion on Nov.15.

Graph showing Bitcoin futures open interest on Binance from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

Meanwhile, CME exhibited even more aggressive growth, with its open interest rising from $9.93 billion to a peak of $17.94 billion within the same period.

Graph showing Bitcoin futures open interest on CME from Oct. 1 to Nov. 15, 2024 (Source: CoinGlass)

The difference between CME and Binance’s market share shows what the market prefers.

Binance, catering to retail and speculative traders, benefits from its global accessibility, lower fees, and broader altcoin derivative offerings. In contrast, CME attracts a more risk-averse, regulation-focused cohort, with institutional investors favoring the exchange’s credibility.

The rise in CME’s open interest to nearly a third of the total market by Nov. 14 points to institutional capital fueling much of the rally. This institutional participation is a strong bullish signal, as it suggests confidence in Bitcoin’s medium- to long-term prospects rather than the speculative fervor often associated with retail.

The impact of the US election is evident in the data. Following Trump’s win on Nov. 5, Bitcoin’s price soared from $67,830 to a high of $93,500 by Nov. 12. Futures mirrored this enthusiasm as the $10 billion increase in open interest from Nov. 7 to Nov. 14 is a result of a surge in leveraged positions as traders rushed to capitalize on the bullish sentiment.

However, the drop in trading volume from $207.04 billion on Nov. 13 to $133.02 billion on Nov. 15 suggests some profit-taking and reduced momentum toward the end of this period, potentially hinting at traders consolidating gains.

Several additional observations can be made from this data. First, the sustained growth in Binance’s open interest indicates robust retail participation despite increased institutional presence in the market.

Second, the correlation between Bitcoin’s price rise and the dramatic increase in futures volume suggests that the spot market’s bullish momentum was amplified by speculative derivatives trading.

Lastly, the market’s preference for CME reflects growing institutional confidence in Bitcoin as a legitimate asset class, a crucial factor for long-term adoption.

The post Bitcoin futures break records with 29% OI surge in November appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Shiba Inu

Shiba Inu  Avalanche

Avalanche  Toncoin

Toncoin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Sui

Sui  Pepe

Pepe  WETH

WETH  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  NEAR Protocol

NEAR Protocol  Polkadot

Polkadot  LEO Token

LEO Token  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Stellar

Stellar  Internet Computer

Internet Computer  Bittensor

Bittensor  dogwifhat

dogwifhat  Ethereum Classic

Ethereum Classic  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Dai

Dai  Hedera

Hedera  WhiteBIT Coin

WhiteBIT Coin  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  Bonk

Bonk  Stacks

Stacks  Render

Render  Monero

Monero  OKB

OKB  Filecoin

Filecoin  Aave

Aave