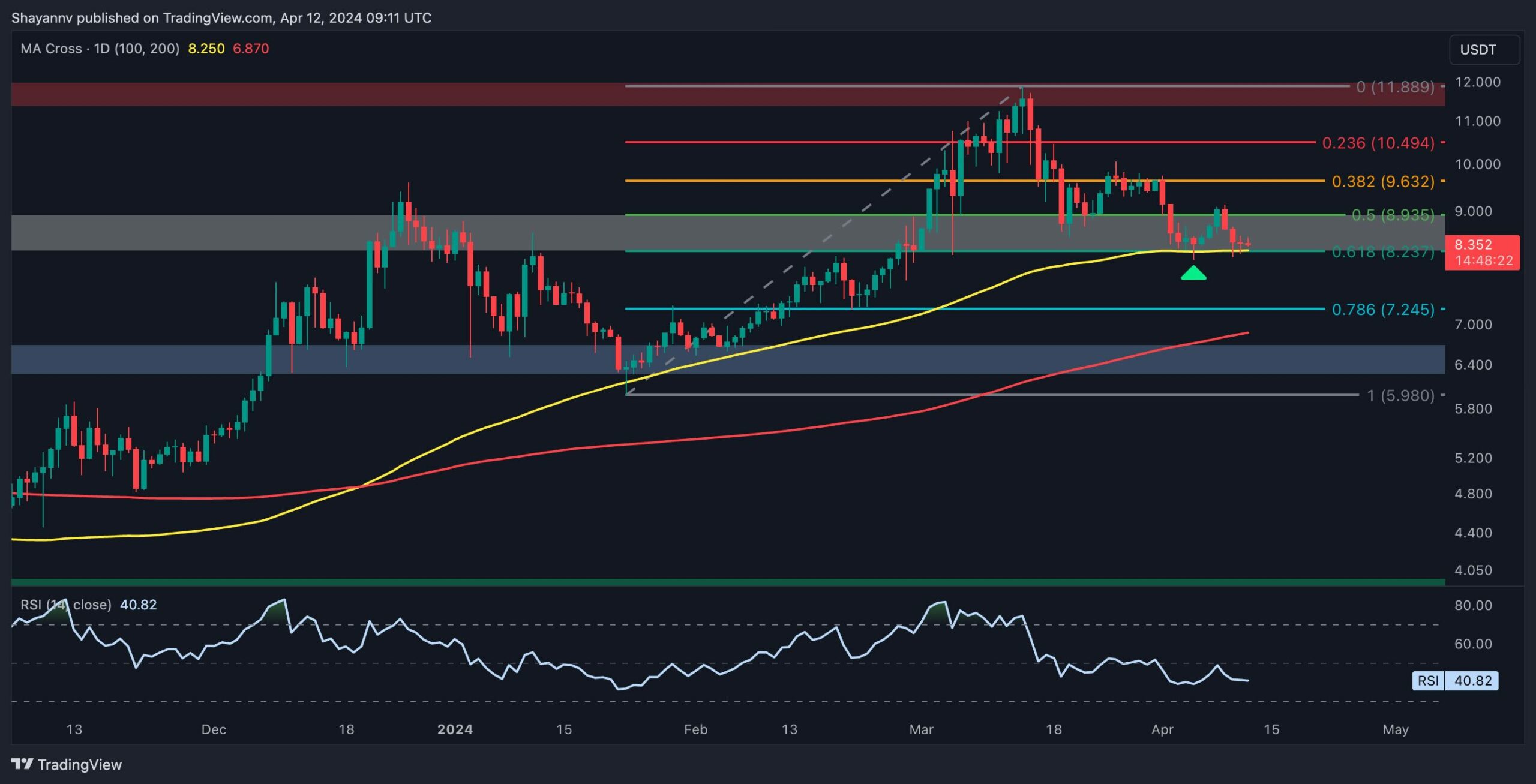

Polkadot’s price is primed for a potential bullish rebound in the medium term, as it has reached a significant and decisive support zone, including the range between the 0.5 and 0.618 Fibonacci retracement levels, as well as the dynamic support provided by the 100-day moving average.

Technical Analysis

By Shayan

The Daily Chart

A detailed examination of the daily chart reveals a substantial downward retracement, with Polkadot experiencing a 30% decline from its yearly high of $11.9. However, sellers have encountered a formidable obstacle in the form of the dynamic support offered by the 100-day moving average, which aligns closely with the critical Fibonacci retracement levels.

This crucial support region is anticipated to prevent further downward pressure, with the market likely to witness a notable rebound in the medium term. The presence of significant demand near this pivotal area is expected to drive heightened buying activity, leading to a renewed surge toward the pivotal $10 threshold in the medium term.

However, it’s important to acknowledge that a sudden decline below this critical support zone could trigger a cascade of long liquidations, potentially leading to a significant drop towards the $7.2 mark.

Source: TradingView

The 4-Hour Chart

A comprehensive analysis of the 4-hour timeframe indicates that Polkadot’s price has recently found support around the crucial $8 level, prompting a period of slight sideways consolidation.

This crucial support zone aligns harmoniously with the lower boundary of a descending wedge pattern, acting as a robust barrier against further downward movement.

Furthermore, a minor bullish divergence has emerged between the RSI indicator and Polkadot’s price, signaling the potential for a bullish revival in the medium term and reigniting market demand.

Consequently, it seems likely that Polkadot’s price will continue to fluctuate within this critical wedge pattern and near the significant $8 support zone until a breakout occurs. Nevertheless, the prevailing sentiment in the market appears bullish, fostering expectations of a renewed upward movement towards the $10 threshold in the medium term.

Source: TradingView

Sentiment Analysis

By Shayan

DOT’s price has undergone a prolonged period of significant corrections, witnessing a 30% decline from its yearly peak of $11.9. Assessing whether this correction has dampened activity in the futures market holds significance for investors.

Presented below is a chart illustrating Polkadot’s aggregate funding rates, which serve as indicators of the intensity with which buyers or sellers are executing their orders. Elevated funding rates often precede a cascade of long liquidations. Thus, while positive funding rates are essential, excessively high values raise concerns.

The chart reveals a recent slight decline in price, accompanied by a continuous drop in funding rates following a notable spike. This suggests a cooling down of the futures market. However, it’s noteworthy that despite this decline, the metric still reflects positive values. Moreover, the futures market appears poised for the re-establishment of long positions.

In light of these observations, this trend can be interpreted as a positive sign, as it reduces the likelihood of further liquidations and sets the stage for a sustainable uptrend in the medium term.

Source: TradingView

This post is powered by Polkadot.

The post Polkadot Price Analysis: DOT Reaches a Significant Decision Point as Bears Unable to Break Below $8 appeared first on CryptoPotato.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  TRON

TRON  Toncoin

Toncoin  Cardano

Cardano  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  WETH

WETH  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Polkadot

Polkadot  Dai

Dai  Uniswap

Uniswap  Sui

Sui  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Aptos

Aptos  Bittensor

Bittensor  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Internet Computer

Internet Computer  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  First Digital USD

First Digital USD  POL (ex-MATIC)

POL (ex-MATIC)  Monero

Monero  Ethereum Classic

Ethereum Classic  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Ethena USDe

Ethena USDe  dogwifhat

dogwifhat  Immutable

Immutable  Aave

Aave  Filecoin

Filecoin  Optimism

Optimism  Cronos

Cronos  Render

Render  Fantom

Fantom  Mantle

Mantle