Bitcoin had a relatively quiet past few days, especially during the weekend, and had stalled at around $67,000 before the bulls initiated a mind-blowing leg up that drove the asset to less than $2,000 away from its ATH of $73,750.

The alternative coins, led by ETH’s rally, are also in the run, and this volatility caused more than $300 million in losses for over-leveraged traders.

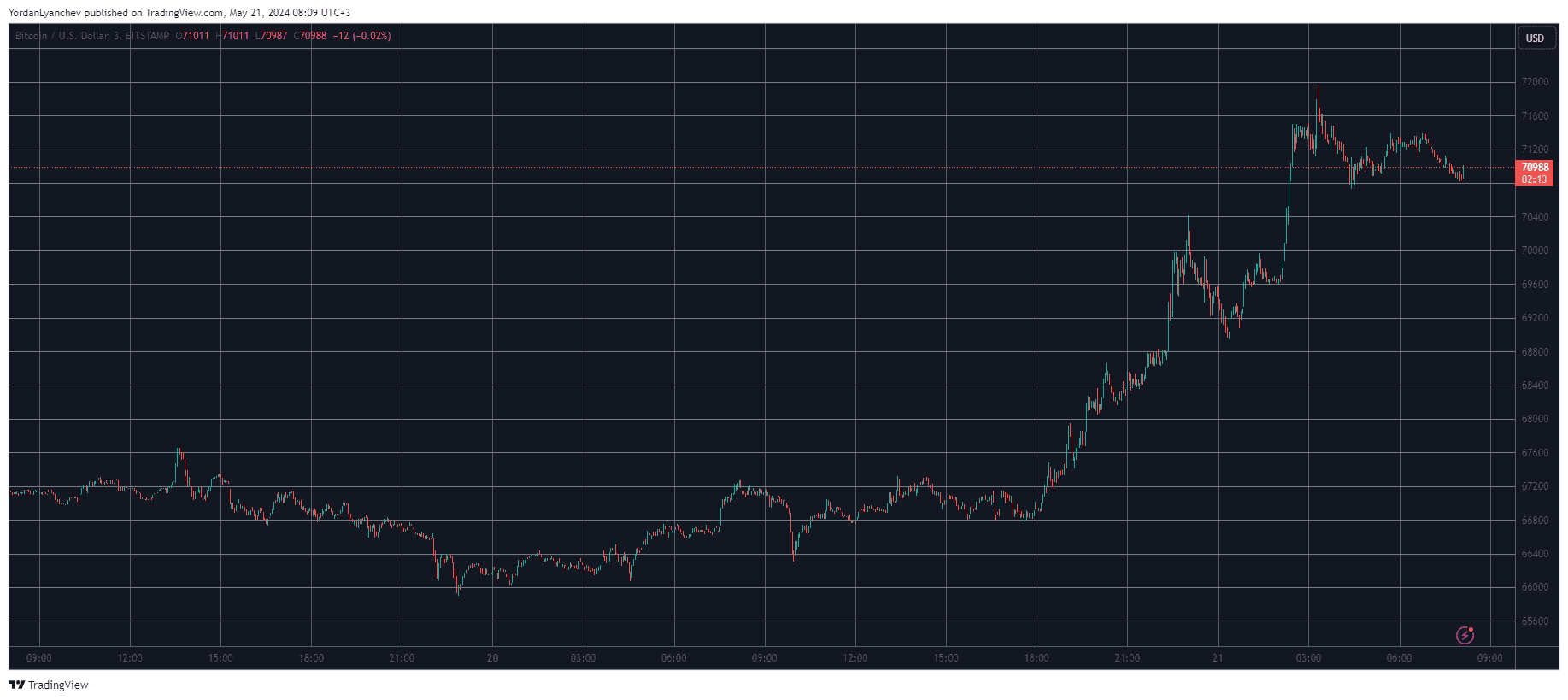

Bitcoin/Price/Chart 21.05.2024. Source: TradingView

The primary cryptocurrency had regained lots of ground in the past week, surging from around $61,000 to $67,000. However, it failed to overcome the latter despite a few consecutive attempts.

That finally happened yesterday evening as the asset flew by the $67,500 resistance and neared $70,000. After a brief retracement from that level, the bulls broke it as well and pushed bitcoin to its highest price position since early April of $72,000.

Despite retracing by around a grand since then, BTC is still 5.5% up on the day. Perhaps one of the reasons behind these latest increases is the ETF inflows, which have reached a six-day streak. Data from FarSide shows that nearly $240 million entered those products on Monday.

However, BTC’s gains are nowhere near those of ETH. The second-largest cryptocurrency skyrocketed from under $3,000 to a multi-month high of its own of over $3,700 amid reemerged hopes of the US SEC approving Ethereum ETFs as early as this week.

At one point, the underlying asset gained over 20%, as analysts started speculating whether it would be able to top $4,000 if those financial products were indeed greenlighted.

The total crypto market cap added roughly $200 billion in a day. Such volatility typically results in lots of pain for over-leveraged traders, and nearly 80,000 of them have been liquidated in the past 24 hours.

The total value of wrecked positions sits at $340 million. Expectedly, ETH is responsible for the biggest piece of the pie, and the largest single liquidated position also belongs to it, which is valued at over $3 million.

Liquidation Heatmap. Source: CoinGlass

The post Here’s How Many Traders Were Wrecked as Bitcoin (BTC) Exploded to $72K Amid Rising ETF Inflows appeared first on CryptoPotato.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  TRON

TRON  Toncoin

Toncoin  Cardano

Cardano  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  WETH

WETH  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Dai

Dai  LEO Token

LEO Token  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  Sui

Sui  Litecoin

Litecoin  Aptos

Aptos  Bittensor

Bittensor  Pepe

Pepe  Wrapped eETH

Wrapped eETH  Internet Computer

Internet Computer  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  First Digital USD

First Digital USD  POL (ex-MATIC)

POL (ex-MATIC)  Monero

Monero  Ethereum Classic

Ethereum Classic  Stellar

Stellar  OKB

OKB  Stacks

Stacks  dogwifhat

dogwifhat  Ethena USDe

Ethena USDe  Immutable

Immutable  Filecoin

Filecoin  Aave

Aave  Render

Render  Cronos

Cronos  Optimism

Optimism  Mantle

Mantle  Fantom

Fantom