Onchain Highlights

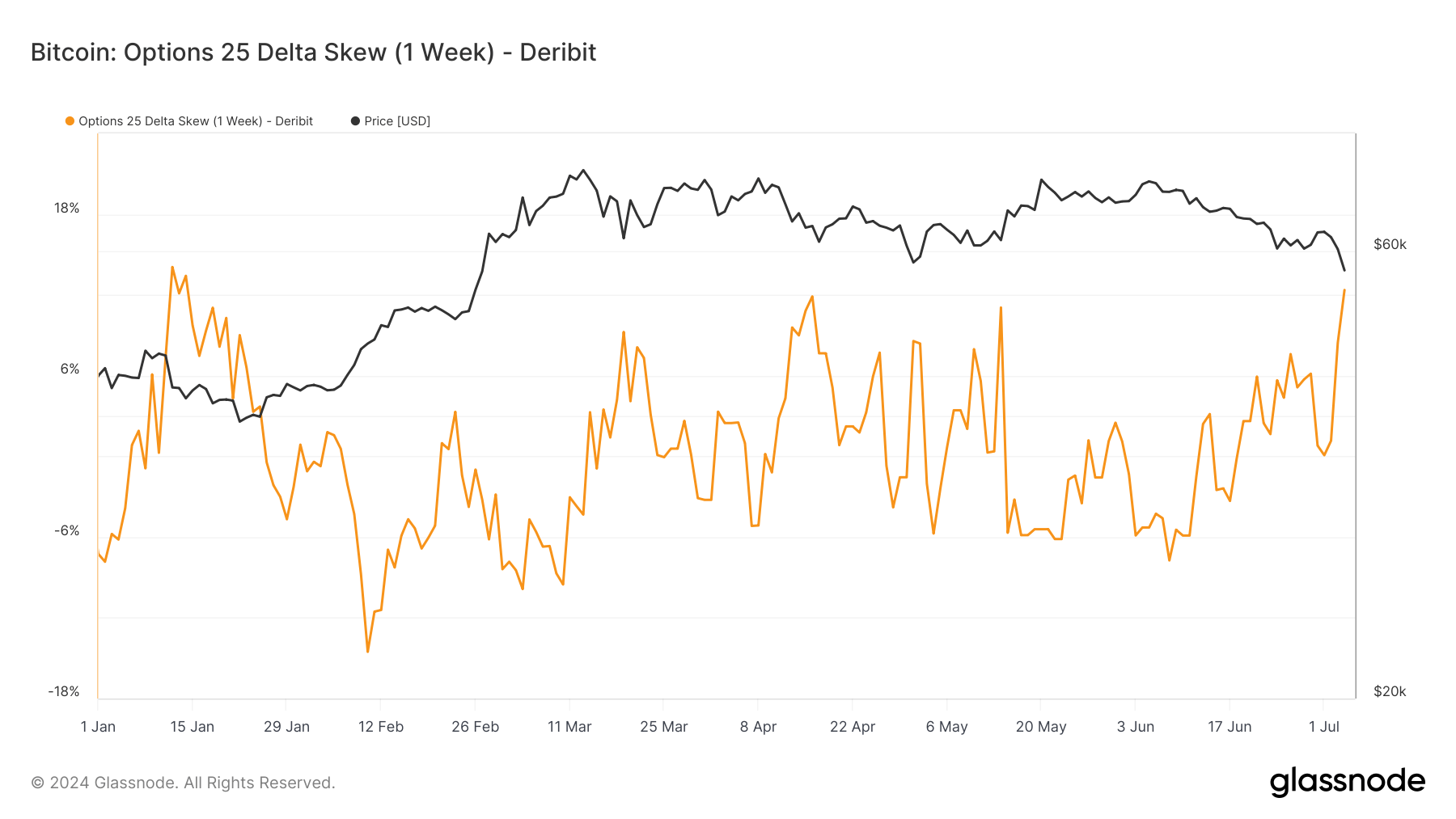

DEFINITION:Skew is the relative richness of put vs call options, expressed in terms of Implied Volatility (IV). For options with a specific expiry, 25 Delta Skew refers to puts with a delta of -25% and calls with a delta of 25% to demonstrate this difference in the market’s perception of implied volatility. 25 Delta Skew is calculated as the difference between a 25-delta put’s implied volatility and a 25-delta call’s implied volatility, normalized by the ATM Implied Volatility. This metrics focuses on option contracts expiring in 1 week.

Bitcoin’s options market has seen significant volatility in the 25 Delta Skew over the past several months. The one-week 25 Delta Skew metric on Deribit, which tracks the difference in implied volatility between 25-delta puts and calls, has fluctuated widely. Since January, the skew has ranged from lows of around -15% to highs exceeding 15%, highlighting the shifting sentiment and market perceptions of risk among options traders.

The latest data shows a sharp increase in the skew due to Bitcoin current correction. Such swings often reflect traders’ shifts between bearish and bullish outlooks.

Bitcoin: Options 25 Delta Skew (1Week): (Source: Glassnode)

For much of 2021 – 2023, the skew’s movements were less pronounced, with fluctuations primarily between -12% and 12%.

Bitcoin: Options 25 Delta Skew (1Week): (Source: Glassnode)

This year’s heightened volatility could indicate increased uncertainty or differing hedging strategies post the April 2024 Bitcoin halving. The halving, which reduces miners’ rewards, typically influences long-term market conditions by constraining supply.

Understanding these dynamics is crucial for anticipating potential price movements, as options skew can serve as a leading indicator of broader market sentiment.

The post Bitcoin’s 25 Delta Skew experiences sharp fluctuations amid correction appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Toncoin

Toncoin  TRON

TRON  Cardano

Cardano  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  WETH

WETH  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Dai

Dai  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Uniswap

Uniswap  Sui

Sui  Litecoin

Litecoin  Bittensor

Bittensor  Pepe

Pepe  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Internet Computer

Internet Computer  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Stacks

Stacks  Stellar

Stellar  Monero

Monero  dogwifhat

dogwifhat  First Digital USD

First Digital USD  OKB

OKB  Immutable

Immutable  Ethena USDe

Ethena USDe  Aave

Aave  Filecoin

Filecoin  Cronos

Cronos  Render

Render  Optimism

Optimism  Injective

Injective  Hedera

Hedera