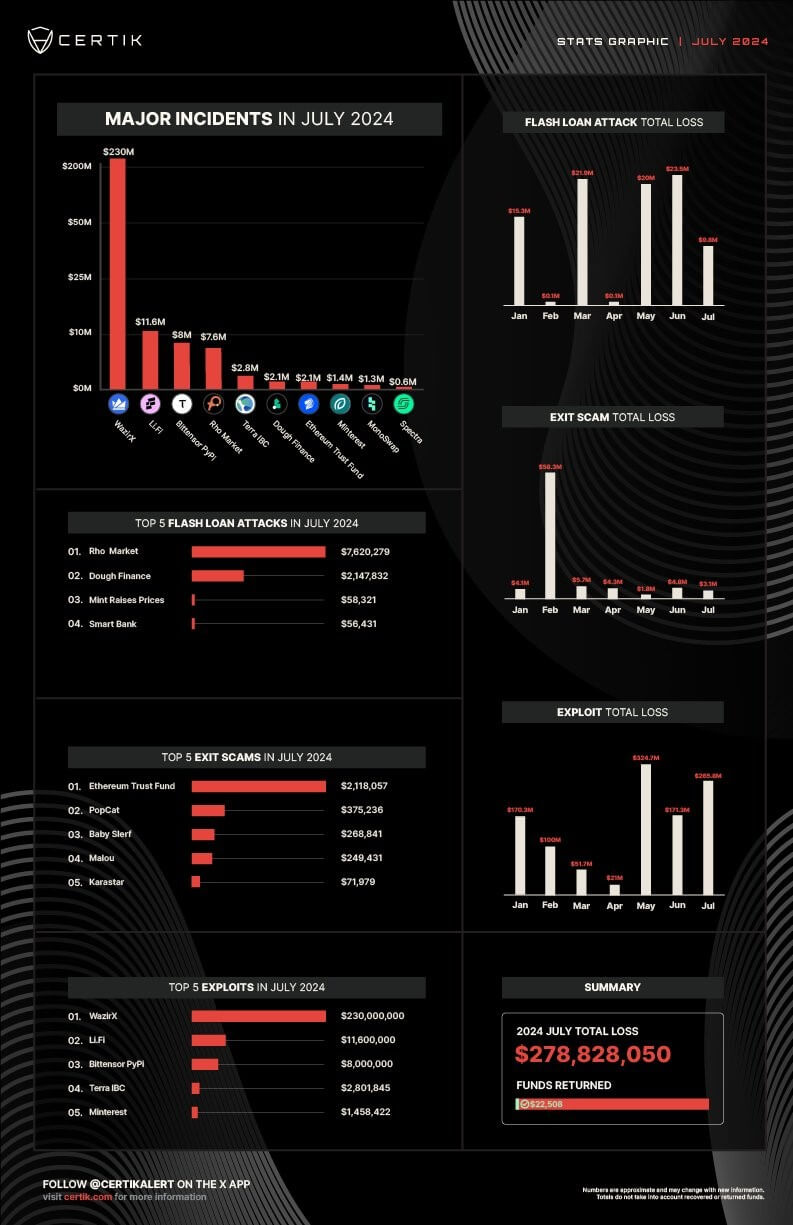

Crypto projects lost $278.8 million to exploits and hacks in July—the second-highest monthly loss this year—according to blockchain security firm CertiK.

CertiK pointed out that the losses were primarily due to exit scams, flash loans, and other exploits. However, $7.8 million of these stolen assets were recovered, reducing the net loss to $270.9 million.

The exploits

Project exploits were the most significant contributors, amounting to approximately $265 million. The top five exploits, including incidents involving WazirX, Li.Fi, Bittensor PyPi, and Terra IBC were responsible for about $253 million.

On July 18, Indian crypto exchange WazirX suffered an exploit totaling $235 million, triggered by suspicious transactions in its Ethereum network multi-sig wallet. Market observers said the attack was linked to North Korea-backed Lazarus Group, which has begun laundering the funds via crypto mixing tools like Tornado Cash.

Meanwhile, the exchange has paused operations and introduced a $23 million bounty to incentivize the attackers to refund the stolen funds. WazirX has also proposed “implementing a socialized loss strategy to distribute the impact equitably among all users.”

Another major exploit last month was the $10 million smart contract exploit of the LiFi protocol. Reports revealed that the platform had suffered a similar attack in March 2022.

Crypto Exploits in July (Source: CertiK)

Flash loan attacks also saw notable incidents. On July 19, Rho Markets, a lending protocol on the Scroll layer-2 network, experienced a $7.6 million exploit on its USDC and USDT pools. The platform later confirmed that the entire amount was recovered from the MEV address.

Dough Finance, a liquidity provider, suffered a $2.1 million loss through multiple flash loan transactions. While some funds were returned, a significant portion was sent to the crypto-mixing tool Tornado Cash.

Furthermore, exit scams contributed roughly $3 million in losses last month.

The post Crypto projects lose $278 million to July hacks, second-highest in 2024 appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  TRON

TRON  Toncoin

Toncoin  Cardano

Cardano  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  WETH

WETH  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Dai

Dai  Polkadot

Polkadot  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Uniswap

Uniswap  Litecoin

Litecoin  Sui

Sui  Aptos

Aptos  Bittensor

Bittensor  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Internet Computer

Internet Computer  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  POL (ex-MATIC)

POL (ex-MATIC)  Monero

Monero  Ethereum Classic

Ethereum Classic  Stellar

Stellar  Stacks

Stacks  First Digital USD

First Digital USD  Ethena USDe

Ethena USDe  OKB

OKB  Immutable

Immutable  dogwifhat

dogwifhat  Aave

Aave  Cronos

Cronos  Render

Render  Filecoin

Filecoin  Optimism

Optimism  Hedera

Hedera  Arbitrum

Arbitrum