The previous week was dominated by news and developments on the spot Ethereum ETF front, while the current one was taken over by Bitcoin exchange-traded funds.

It almost felt inevitable after the launch of all US spot Bitcoin ETFs in early January that the BlackRock product will surpass that of Grayscale, which was actually converted from the former BTC Trust. Grayscale’s GBTC saw substantial outflows ever since it first reached the US markets, while BlackRock’s IBIT kept attracting billions of dollars worth of the primary cryptocurrency.

This moment finally occurred earlier this week as it took the world’s largest asset manager just 96 days to become the biggest Bitcoin ETF issuer. Currently, Grayscale’s fund has $19.7 billion in BTC, while IBIT holds $19.97, according to SoSoValue.

Another major event within the Bitcoin ETF landscape came on Tuesday when all such products, not just those in the US, attracted just over one million BTC.

These positive developments on the ETF front didn’t result in substantial gains for the underlying asset. In fact, bitcoin tried to take down the $70,000 mark on a few occasions and, although it breached it once, couldn’t succeed and currently sits about three grand away from it.

The weekly charts among most altcoins are quite less eventful than they were last time. However, some of the meme coin representatives have taken the main stage. PEPE, for instance, charted a few all-time highs this week, while WIF is up by more than 20%. Additionally, the meme coin realm saw the entrance of a celebrity, but more on that later.

Market Data

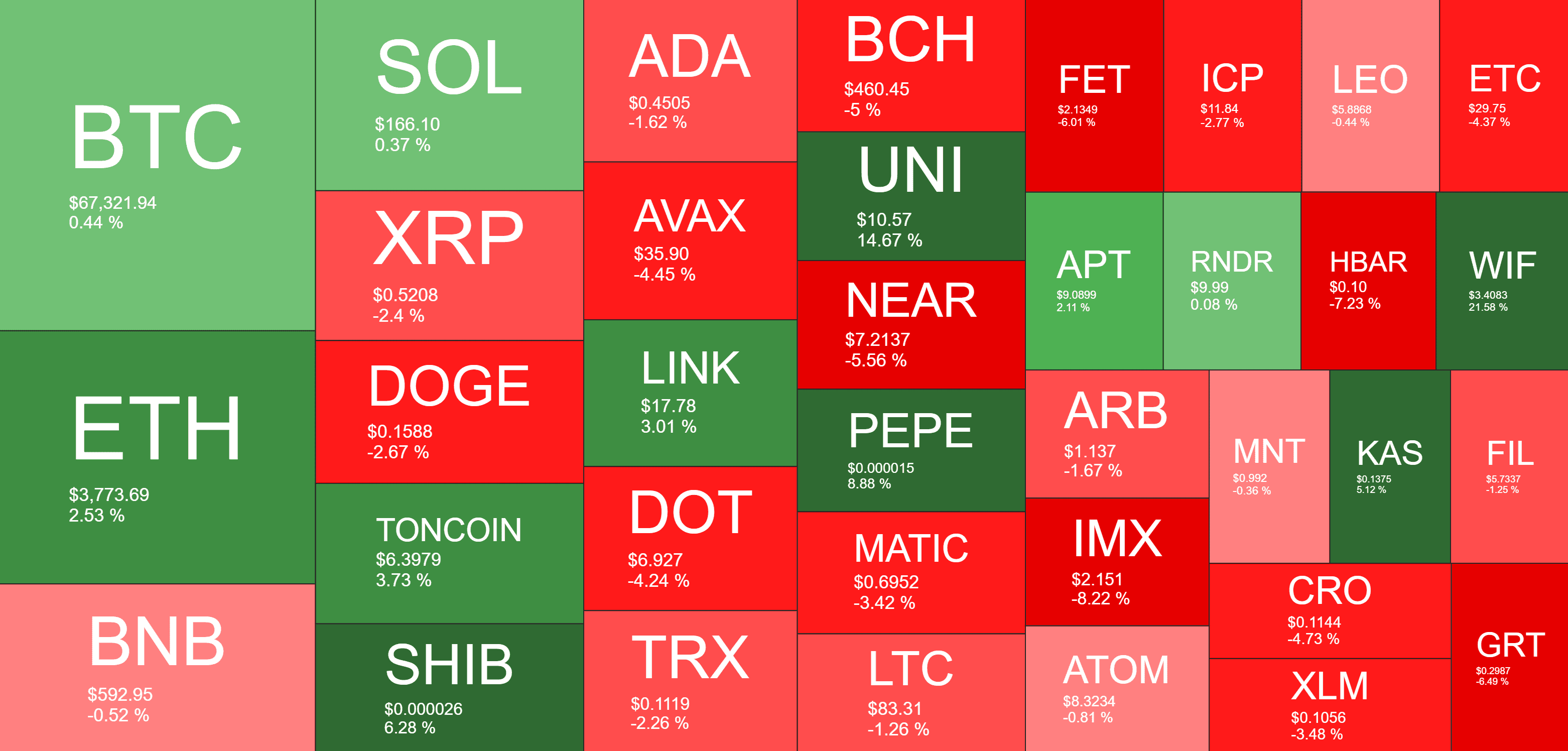

Market Cap: $2.667T | 24H Vol: $80B | BTC Dominance: 50%

BTC: $67,320 (+0.44%) | ETH: $3,773 (+2.5%) | BNB: $593 (-0.5%)

This Week’s Crypto Headlines You Can’t Miss

Ethereum Whales with Over 10,000 ETH Surging, Signaling Accumulation Trend. Although ETH’s price has been consolidating in the past week, ever since the massive surge experienced by the Ethereum ETFs news, the asset has been targeted by large investors who have been on an accumulation spree.

U.S. Spot Bitcoin ETFs See Longest Inflow Streak Since February. Adding to the massive achievements on the Bitcoin ETF front, these products have been on an impressive streak since mid-May. In fact, they are currently on the longest inflow streak in over three months, with 13 consecutive days and counting.

Caitlyn Jenner’s JENNER Meme Coin Sends Traders into a Tailspin. As mentioned above, a certain celebrity entered the meme coin ecosystem. Despite initial rumors about a hack, it turned out that Caitlyn Jenner has indeed launched a dozen meme coins on the Solana blockchain with the hope of making a quick buck.

Most Profitable Among Big Meme Coins: Over 96% of PEPE Holders in Profit. Even though PEPE retraced slightly after charting a few consecutive all-time highs, the number of token holders in profit skyrocketed to over 96% yesterday, as reported.

Gemini Earn Recovers 97% Of Customers’ Lost Crypto. Good news for Gemini Earn customers: After over a year of controversy and uncertainty, the bankrupt crypto lending arm announced that it had recovered almost all lost funds.

Former FTX Exec Ryan Salame Sentenced to 7.5 Years in Prison. One of the closest FTX execs to Sam Bankman-Fried – Ryan Salame – was sentenced to over seven years in prison. Previously, Salame’s lawyers asked for no more than 18 months.

Charts

This week, we have a chart analysis of Ethereum, Ripple, Cardano, Shiba Inu, and Polkadot – click here for the complete price analysis.

The post Big Week for Spot Bitcoin ETFs, Meme Coin Mania Reaches Celebrities, and More: This Week’s Crypto Recap appeared first on CryptoPotato.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  Lido Staked Ether

Lido Staked Ether  XRP

XRP  Toncoin

Toncoin  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Polygon

Polygon  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Ethena USDe

Ethena USDe  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Renzo Restaked ETH

Renzo Restaked ETH  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Monero

Monero  Aptos

Aptos  Render

Render  Stellar

Stellar  Hedera

Hedera  OKB

OKB  Cosmos Hub

Cosmos Hub  Arbitrum

Arbitrum  Cronos

Cronos  Mantle

Mantle  Filecoin

Filecoin  Stacks

Stacks  Immutable

Immutable  Maker

Maker  Injective

Injective  First Digital USD

First Digital USD  Sui

Sui