Quick Take

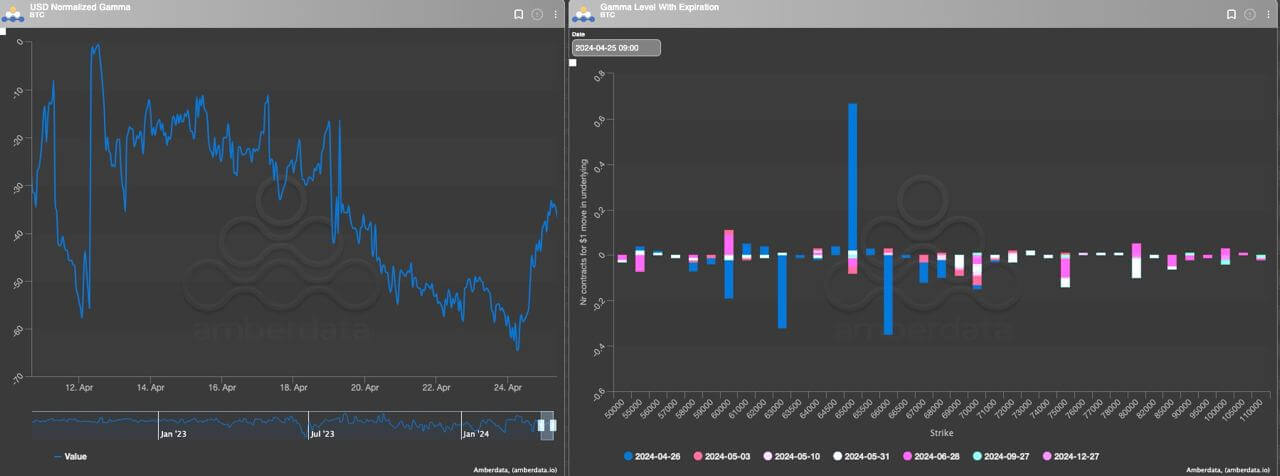

As Bitcoin’s price hovers around $63,000, slightly down over the past 24 hours, the options market is providing insights into shifting investor sentiment ahead of the expiration on April 26. A key development has been the reduction in positive gamma exposure as Bitcoin declined through the heavily traded $65,000 call strike.

According to Imran Lakha, a 20-year professional options trader notes:

Short gamma reduced on the way down as we went through the big long strike at 65k suggesting volume has been smashed lower, calls are getting dumped

Bitcoin Gamma Level: (Source: laevitas)

The options open interest data provided by Deribit reveals a max pain price of $61,000, which could potentially serve as a short-term support level. While significant open interest remains in calls above the current spot price, the lack of put open interest below $60,000 indicates a lack of downside protection. CryptoSlate has pinpointed this price level as a crucial support threshold.

April 26 expiration, Open Interest by strike price: (Source: Deribit)

The put/call ratio of 0.68 reflects a modest bias towards calls, but this has decreased notably due to likely profit-taking on downside hedges.

In conclusion, the options market data suggests a cooling of bullish sentiment as Bitcoin pulled back from recent highs. However, the remaining upside option holdings could still influence short-term price action, with the max pain level as a potential support zone to monitor.

The post Bitcoin options signal cooling bullish sentiment as key support level emerges at $61,000 appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Toncoin

Toncoin  TRON

TRON  Cardano

Cardano  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  WETH

WETH  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Dai

Dai  LEO Token

LEO Token  NEAR Protocol

NEAR Protocol  Uniswap

Uniswap  Sui

Sui  Litecoin

Litecoin  Aptos

Aptos  Bittensor

Bittensor  Pepe

Pepe  Wrapped eETH

Wrapped eETH  Internet Computer

Internet Computer  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Monero

Monero  Stellar

Stellar  Stacks

Stacks  First Digital USD

First Digital USD  OKB

OKB  Ethena USDe

Ethena USDe  Immutable

Immutable  dogwifhat

dogwifhat  Aave

Aave  Cronos

Cronos  Filecoin

Filecoin  Render

Render  Optimism

Optimism  Hedera

Hedera  Arbitrum

Arbitrum