BlackRock’s iShares Bitcoin Trust (IBIT) has surpassed every exchange-traded fund (ETF) launched in the past decade in terms of total assets.

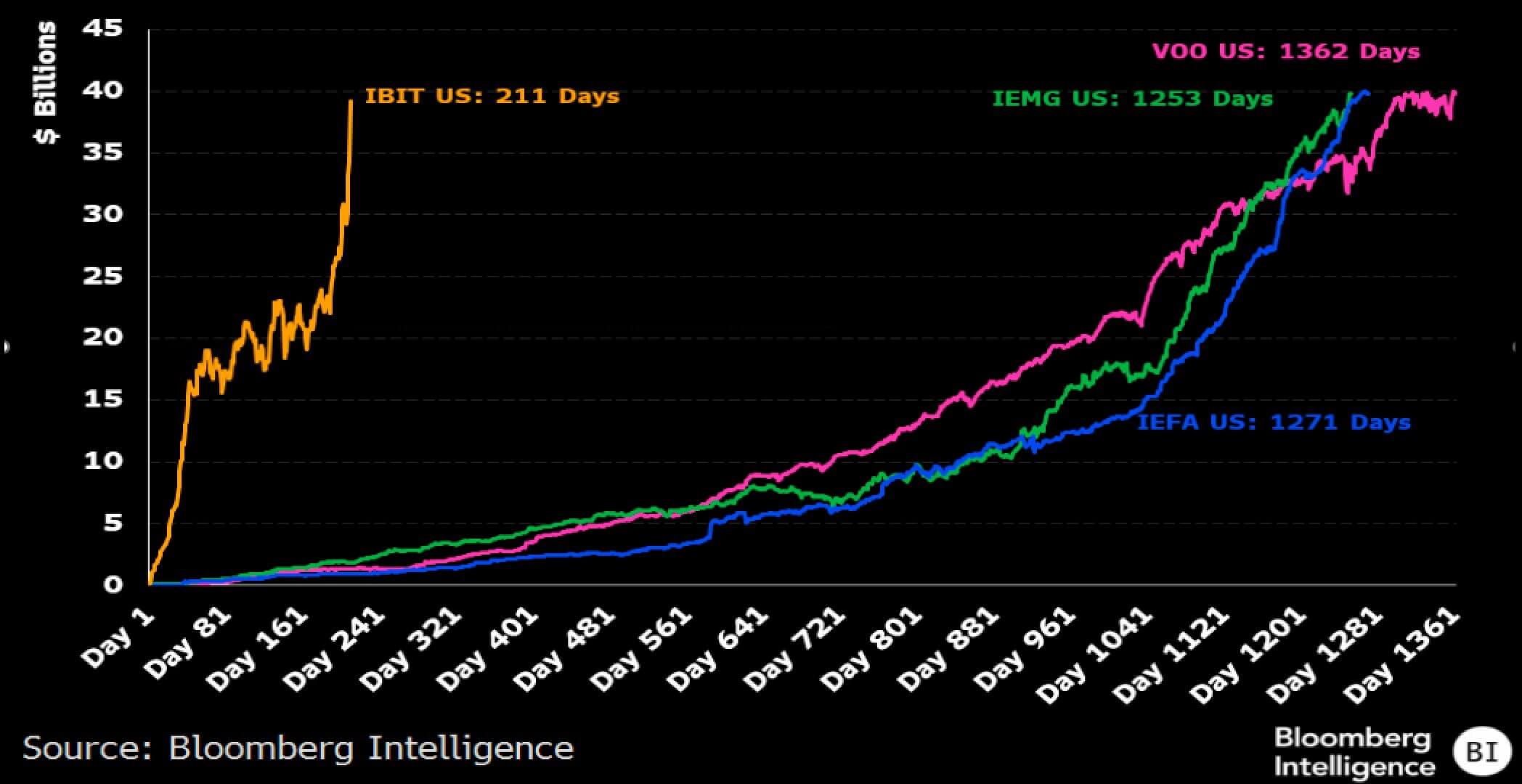

On Nov. 13, Bloomberg’s ETF analyst Eric Balchunas reported that IBIT reached $40 billion in assets— just two weeks after hitting $30 billion. This achievement came in a record 211 days, almost 6x lower than the previous record of 1,253 days set by the iShares Core MSCI Emerging Markets ETF (IEMG).

BlackRock’s IBIT Assets (Source: X/Balchunas)

At just 10 months old, IBIT has already become one of the top 1% of ETFs by assets. It has surpassed the total assets of all 2,800 ETFs launched over the last ten years, a remarkable achievement considering most ETFs take years to accumulate substantial value.

Meanwhile, IBIT also stands fourth among US ETFs for 2024 inflows, having attracted more than $28 billion so far. It is the only crypto-related ETF in the top 10.

Top 10 US ETFs by Inflows (Source: X/Balchunas)

These impressive numbers highlight the increasing demand for Bitcoin exposure in mainstream investment portfolios. Its success also suggests strong momentum behind digital asset ETFs, which may become a lasting fixture in traditional finance.

The post BlackRock’s Bitcoin ETF climbs to top 1% in record-breaking 211 days appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Shiba Inu

Shiba Inu  Avalanche

Avalanche  Toncoin

Toncoin  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Sui

Sui  Pepe

Pepe  WETH

WETH  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Litecoin

Litecoin  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  USDS

USDS  Cronos

Cronos  Stellar

Stellar  Internet Computer

Internet Computer  Bittensor

Bittensor  dogwifhat

dogwifhat  Ethereum Classic

Ethereum Classic  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Dai

Dai  WhiteBIT Coin

WhiteBIT Coin  Ethena USDe

Ethena USDe  Hedera

Hedera  POL (ex-MATIC)

POL (ex-MATIC)  Bonk

Bonk  Stacks

Stacks  Render

Render  Monero

Monero  OKB

OKB  Filecoin

Filecoin  FLOKI

FLOKI