Quick Take

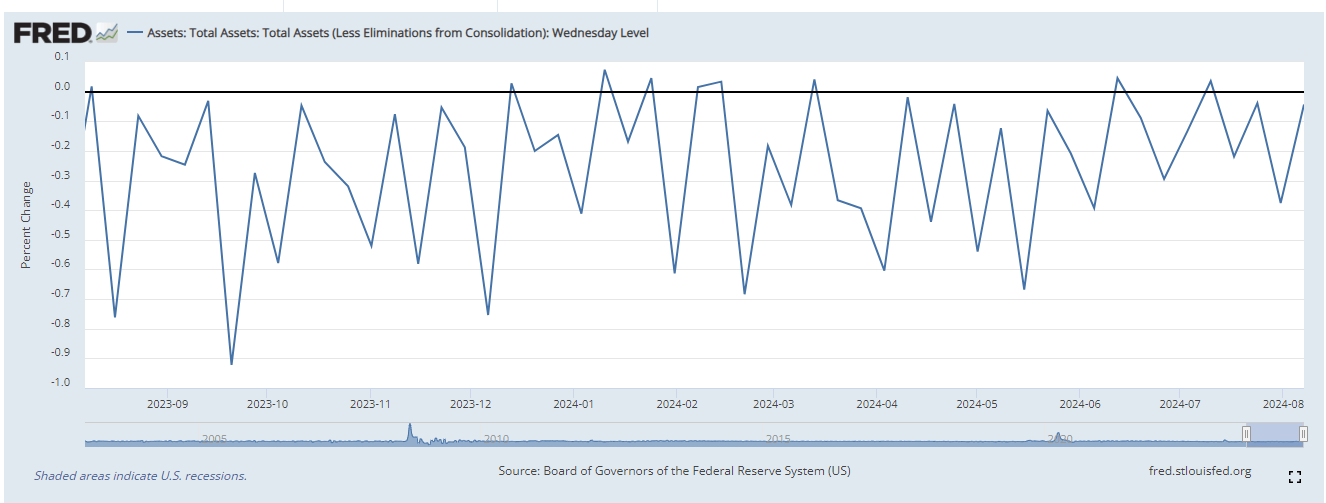

FRED shows that the Federal Reserve’s balance sheet continues to experience gradual quantitative tightening (QT), with a negligible $3.1 billion decline, bringing the total to $7.2 trillion. This marks one of the smallest QT moves in the past year, indicating a cautious approach by the Fed. While the overall trend is a long-term decrease, there have been instances of quantitative easing (QE) where the balance sheet increased week-over-week.

Fed Balance Sheet % Change: (Source: FRED)

Meanwhile, US debt continues its rapid ascent, surpassing $35.1 trillion, highlighting ongoing fiscal challenges. The M2 money supply, which includes cash in hand and short-term deposits, stands at $21 trillion, according to FRED, meaning the US has more debt outstanding than money in circulation—a concerning metric for economic stability.

In the financial markets, recent volatility has seen a rally following a sharp drop earlier in the week. Investors are now pricing a 100% chance of a rate cut at the upcoming Federal Reserve meeting on Sept. 18. The market is split between expecting either 50 basis points (bps) or a 25 bps cut, reflecting uncertainty about the Fed’s next move in its monetary policy. This uncertainty continues to keep market participants on edge.

Fed Watch Tool: (Source: CME)

Bitcoin is currently trading around $60,000, reflecting a 4% increase over the past week.

The post Market braces for rate cuts as Fed’s Quantitative Tightening slows appeared first on CryptoSlate.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  TRON

TRON  Toncoin

Toncoin  Cardano

Cardano  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  WETH

WETH  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Dai

Dai  Polkadot

Polkadot  Uniswap

Uniswap  LEO Token

LEO Token  Sui

Sui  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  Bittensor

Bittensor  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Internet Computer

Internet Computer  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  First Digital USD

First Digital USD  Monero

Monero  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Ethena USDe

Ethena USDe  dogwifhat

dogwifhat  Immutable

Immutable  Aave

Aave  Filecoin

Filecoin  Cronos

Cronos  Render

Render  Optimism

Optimism  Mantle

Mantle  Injective

Injective