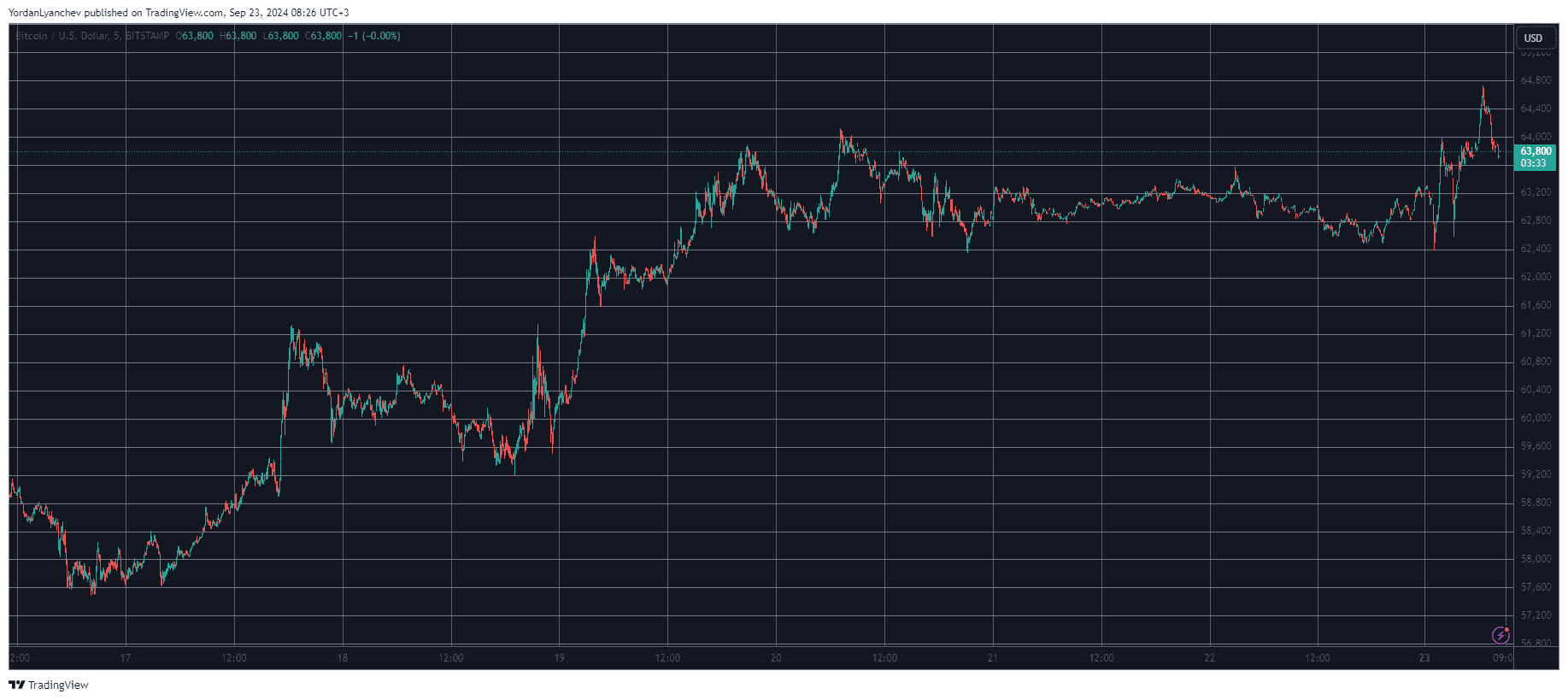

After a quiet weekend in which it stood primarily around $63,000, BTC went on the offensive during the Monday morning Asian trading session but was stopped at just under $65,000.

The subsequent rejection brought some more volatility to the market, which has liquidated over 60,000 traders on a daily scale.

Bitcoin’s price actions were quite positive in the past several days, especially since the US Federal Reserve cut the key interest rates in the country by 0.5% on Wednesday. BTC reacted with immediate price fluctuations but the bulls prevailed and drove the asset north, culminating in a price surge to over $64,000 on Friday morning.

The cryptocurrency failed to keep going up and lost some momentum during the weekend. As reported, it traded in a tight range of around $63,000 for the most part.

More volatility ensued on Sunday evening and Monday morning. First, BTC dropped to $62,400, shot up to $64,000, slipped by a grand and a half again, and initiated an impressive leg up hours ago.

This resulted in a price surge to a four-week high of $64,800 (on Bitstamp). Yet, the bears were quick to intercept and stop BTC’s rally. As of now, the asset trades about $1,000 lower.

Bitcoin/Price/Chart 23.09.2024. Source: TradingView

Many altcoins mimicked BTC’s performance, but some, such as ETH and BNB, have gained more than 2% on a daily scale. ETH stands above $2,650, while BNB has neared $600.

This substantial volatility has harmed over-leveraged traders, with almost 62,000 such market participants being wrecked on a daily scale. The total value of liquidated positions is up to $165 million, according to CoinGlass.

The single-largest liquidated position actually involved ETH and was worth $2.73 million. It took place on Binance.

The post Over $160 Million in Liquidations as Bitcoin (BTC) Got Rejected at $65K appeared first on CryptoPotato.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  TRON

TRON  Toncoin

Toncoin  Cardano

Cardano  Avalanche

Avalanche  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  WETH

WETH  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Polkadot

Polkadot  Dai

Dai  Sui

Sui  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Bittensor

Bittensor  Aptos

Aptos  Pepe

Pepe  Wrapped eETH

Wrapped eETH  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Internet Computer

Internet Computer  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Stellar

Stellar  Monero

Monero  Stacks

Stacks  First Digital USD

First Digital USD  dogwifhat

dogwifhat  OKB

OKB  Ethena USDe

Ethena USDe  Immutable

Immutable  Filecoin

Filecoin  Aave

Aave  Cronos

Cronos  Optimism

Optimism  Render

Render  Injective

Injective  Arbitrum

Arbitrum